Sony Part 1: Microchips, Cameras & Collaboration

- Thomas Aouad

- Aug 2, 2021

- 16 min read

This is the first of three research notes covering Sony Group. The focus will be on the cooperation between the group’s primary businesses and how this characteristic results in high quality and durable competitive advantages within each business. In short it will be an argument against the breakup of the company.

A conglomerate structure only masks the true value of Sony’s underlying businesses, it does not destroy this value. In contrast, the extensive collaboration between each business creates value in Sony’s case as we see in the body of this note.

Sony's conglomerate structure is a negative only for short- to medium-term investors. In contrast the long-term holder benefits from sustained undervaluation as profits can be reinvested at a discounted price. When combined with the growth drivers Sony’s multiple business segments currently benefit from the company appears obviously undervalued.

Market participants currently act as cheerleaders for the FANG stocks to expand their businesses into music streaming, content creation, game publishing and inhouse chip design. Examples include Apple with their M1 processors, Apple TV+ and Apple Music, Amazon with Amazon Prime Video, Music and now Amazon Games. This list goes on including Microsoft, Google, Facebook, and Netflix. All of these forays are seen for what they are, long-term plays at increasing the durability of competitive advantages whilst growing total group earnings.

Sony Group currently operates within all of the above areas, it is already diversified. Yet, in contrast to the FANG stocks, the current market consensus, demands their separation. The market thesis is justified by the expected realisation of immediate returns due to the elimination of the conglomerate discount each business bears. Perfect for the short- and medium-term investor.

We can quantify the detachment of market value by comparing Sony’s current market cap (MV) to a sum of the parts (SOTP) valuation. It is a running joke that a SOTP valuation has never amounted to less than a company’s current MV, however, in this case the gap between market price and valuation built upon the business reality is wide enough to erase any doubt.

In this first Sony report we examine Sony’s Semiconductor and Electronics businesses. We discover collaboration between the two segments, significant growth drivers, durable competitive advantages and healthy cashflows. Next month’s report will cover Sony’s gaming, music, and film businesses, highlighting further collaboration, growth, and what appears to be even more durable competitive advantages.

Imaging & Sensing Solutions (I&SS)

Sony Semiconductor Manufacturing designs the world’s leading CMOS image sensors. If you have a new iPhone then you are shooting on a Sony CMOS sensor. CMOS sensors turn real world data, light photons, into digital data, 1’s and 0’s, that can be stored and transferred. The two distinct parts of a CMOS sensor are the pixel chip and the logic chip.

The process of converting light into information is distinct from a CPU or GPU which process digital input data, in the form of 1’s and 0’s, into digital output data again in the forms of 1’s and 0’s. The CMOS sensor is converting continuous data in the form of ‘real world’ light waves and particles into discrete data in the forms of 1’s and 0’s.

Analog processing performed on the pixel chip relies much less on industry standards and protocols due to the simple fact that the real world is infinitely more complex and volatile than the digital world. This results in much higher product differentiation amongst semiconductors containing analog componentry such as CMOS image sensors than purely digital semiconductors such as logic and memory chips.

Sony’s CMOS sensors are leading edge in their design and fabrication, and as a result are used in premium smartphones. Sony design and assemble the entire CMOS sensor. The logic chip is outsourced and purchased from an external supplier, whilst Sony design and fabricate the pixel chip. Sony are leaders in this analog aspect of CMOS sensor design.

To get an idea of this process and chip design the components of a CMOS sensor are depicted in the following diagram provided by Sony:

Photodiodes and other elements that convert incident light into charge are formed on silicon wafers. This is analog circuity, the most differentiating area of image sensor design, is where Sony are world leaders.

Each element formed in the substrate process is connected with metal wire.

Pixel wafers and outsourced logic circuit wafers are stacked.

Colour filters that transmit each RGB light and on-chip lens are formed over pixels.

Product quality and reliability is confirmed in the resulting wafer form.

The I&SS business’s growth has so far been driven by demand for smartphones. The quality of a smartphone’s camera has become a key area of product differentiation amongst premium smartphone manufacturers. Sony has benefited from competition in this area with increased demand for their CMOS sensors as manufacturers have added multiple cameras to each smartphone.

Demand for CMOS sensors from auto makers will accelerate growth in demand for CMOS sensors over the coming decades. Autonomous driving is fast emerging as one of the key areas of product differentiation amongst new car models. Electrified vehicles are simpler in their design and manufacturing, hence the level of functionality and reliability offered in the area of autonomous driving will likely become a critical area of differentiation. We predict this will be similar to how cameras are a differentiator in the smartphone market.

Sony is positioned well to take advantage of the growth autonomous driving offers. The company currently has image sensors far superior to their competition and is competing on capability rather than price. An example of this superiority is illustrated below between a competitors current LiDAR technology and a LiDAR equipped with a Sony CMOS sensor.

It is a reassuring sign that Sony are not heavily discounting prices of their sensors to gain market share in the automotive supplier market, which is renowned for cut-throat competition. Rather they are sticking to their guns with what they know are products superior to those offered by the competition.

Any market share they successfully capture through this strategy will be of significantly higher quality than any quick land grabs achieved with discounting. The avoidance of discounting is a strong sign of a quality business being steered by a long-term focused management team. The below excerpt from the FT highlights evidence of this approach at Sony:

“I kept on asking why we couldn’t reverse our market position despite our sensors obviously being better than others,” said Terushi Shimizu, head of Sony’s semiconductor unit, which was the group’s most profitable division in the last quarter.

“But we didn’t want to be drawn into the cost-cutting competition. We want our sensors to be used because our technology is better,” Mr Shimizu said.

Sony has been investing heavily in the I&SS business. The 5-year average of capex/sales sits at 17.52% compared to a depreciation/sales ratio over the same period of 13.02%. This is shown more clearly in the below chart:

Sony saw incredible growth as smartphones added multiple cameras, though the number of CMOS sensors per device will be dwarfed by the number each autonomous car will require. The Tesla Model S currently features 8 image sensors, providing basic driver assistance with no use of LiDAR technology. Sony’s prototype autonomous vehicle, which it has developed to test its technology, the VISION-S, has 18 cameras and 4 LiDAR. It would be reasonable then to ballpark an advanced semi-autonomous vehicle as having somewhere in the vicinity of 10-15 CMOS sensors whilst an advanced fully autonomous vehicle will likely have more.

Roughly 1.5 billion smartphones and 75 million new cars are sold each year. With an average of 2.5 CMOS sensors per smartphone and 10-15 CMOS sensors per semi-autonomous/fully-autonomous vehicle it would appear that the autonomous vehicle market could offer a potential market roughly half the size of the global smartphone market. This also assumers CMOS sensors used in the automotive industry continue to cost roughly 30% more per sensor than those used in smartphones.

Sony as of mid-2020 has captured 9%[1] of the automotive CMOS sensor market, up from 3% in 2018[2]. As previously described the automotive supplier market is incredibly competitive, however, Sony will not face one critical headwind. Samsung who controls over 20% of the global smartphone market is also a competitor in the manufacturer of CMOS sensors, which are used within its own phones. Within the automotive market there is no similar instance of vertical integration.

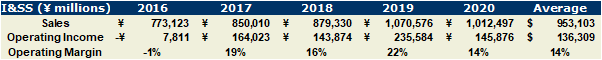

As we can see below the business has maintained operating profit margins even in the face of the Huawei sanctions implemented by the US government. These sanctions severely impacted Sony. Huawei were Sony’s second largest customer for CMOS sensors behind Apple. This above mentioned vertical integration of Samsung left slim pickings to fill the hole left by Huawei, though Sony has continued to find applications and customers for its leading CMOS sensors. This has been done whilst maintaining and improving the trailing average of operating margins as depicted below:

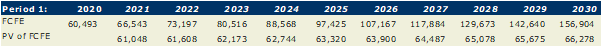

A back of the envelop valuation of the I&SS business is our best option to value the business given the above mentioned growth drivers and the limited information provided by Sony. Average net capex from our first table is assumed to be 5% of sales whilst operating margins are forecast at 15%. Once adjusting for tax and interest expenses we are left with FCFE in the range of 10% of sales.

We have used a 10% growth rate for Period 1, which is 10 years long. Compounded over 10 years at 10% gets us to an I&SS business that is 2.6 times the size it is today. How did we mechanically get to this 10%? we assume that in 10 years the automotive sensor market is 50% the size of today’s smartphone market, for the reasons we have previously walked through. That leaves 110% growth left over, which is a CAGR of 7.7%. This 7.7% CAGR is roughly the rate Sony has grown the imaging sensor portion of its I&SS business since it started reporting on the segment in 2015, we have simply used the average for the existing business. We have also used this long-term average for the terminal growth rate.

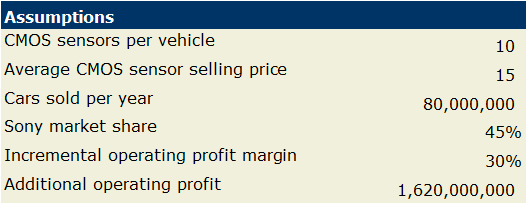

This also reconciles with a unit economics forecast. In this forecast we assume every new car sold in 2031 has level 2 autonomy as standard. Each of these new cars sold will require 10 CMOS sensors at an average selling price of $15. Combining this with an assumption that Sony captures 45% of the market, the same portion of the smartphone market they currently control, and experiences 30% incremental operating profit margins, produces USD 1.6 billion in additional operating profit. This is just under 50% of the I&SS segment’s current operating profit. The assumptions are also pictured below:

We believe these average selling prices to be bearish. Given the cost of systems currently being implemented it would be reasonable to believe that the market is basing its market size expectations off of Tesla’s cost centric approach. Tesla have the lead in terms of generating noise around their basic driver assistance and the below excerpt from Electronic Engineering Times Asia highlights their cost focus in a comparison to the systems implemented by BMW and Tesla:

"By choosing mature image sensors from On Semiconductor and adding no post-processing, Tesla made its camera module ‘not about having the newest image sensors, but all about cost,’ System Plus observed. The firm estimates the cost of ZF’s tri-camera at $165, while Tesla’s tri-camera is at $65"

Taking all of the above factors into account results in an ultimate valuation output for the I&SS business of roughly ¥JPY 4 trillion, or $USD 40 billion, as depicted below:

Electronics Products & Solutions (Sony Corporation)

Sony’s electronics division, Sony Corporation, was the crown jewel of the Sony Group. Leaders in analog technology that redefined how people experienced music and video. This legacy hamstrung management at the dawn of the digital era and combined with the transition to the first non-founder CEO saw the company fall behind its competitors for the first decade of the digital age. Sony Corporation began to be seen by the investment community and media as the black sheep of Sony Group. Today it is still largely seen as unwanted baggage leftover from the company’s past, clung onto by management who don’t have the heart to close the book on Sony’s founding business and the nostalgia of success it brings with it.

This couldn’t be further from the truth. We will see how Sony Corporation and Sony Semiconductor Manufacturing are working together to redefine the interchangeable lens market to the fanfare of content creators.

The majority of Sony Corporations activities are concerned with the design, manufacture and sale of TV’s and cameras. To do this components are researched, procured, assembled and then the final products marketed to the public for sale both directly and through retailers. What determines how much cash the business can keep from this process is how well each component is understood, the cost it can be procured, leading to a cost effective and superior device design and manufacturing process, with the devices features, capabilities and quality then being messaged effectively to consumers.

The competitiveness of the consumer electronics market exerts great pressure upon every step of this process, from procurement to marketing. Businesses which fail to execute within any of these areas are forced to compete solely on price, the least ideal scenario.

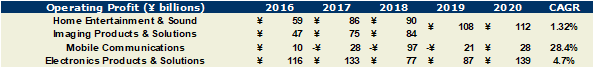

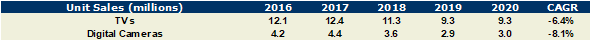

Sony Corporation manages to execute well enough within each process to generate considerable cash flows. It is clear that Sony Corporation is now exiting a transitionary period and cementing itself as a profitable premium consumer electronics brand. Units shipped and revenue is declining, whilst operating profit and revenue per unit continues to rise. More is coming in whilst less has to go out.

This turnaround period was instigated in 2012 by the company’s previous CEO and continued by the current CEO who has managed to stem cash outflows from the company’s mobile business.

The turnaround was defined by a strategy shift to focus upon profitability rather than market share. The hangover of Sony Corporation’s glory days in consumer electronics lingered strongly within management and the decision to surrender market leadership in TVs, batteries and personal computers to the Korean and Taiwanese champions LG, Samsung, Asus and Acer was not an easy strategy for the old guard to accept.

The implementation of this strategy was defined by:

Shrinking the company and focusing on profitability

Reducing costs, just under a third of staff were let go

Exiting the battery manufacturing, camera module and PC (VAIO) businesses

Moving production to countries with cheaper labour in SE Asia

Focusing on higher margin premium TVs which are also more profitable for resellers rather than focusing on market share

A look at Sony Corporation’s successful Alpha line of mirrorless cameras shows how the Sony Group has broken down the walls of its siloed businesses, upending the interchangeable lens camera market in the process.

If we ask ourselves what Sony Corporation’s purpose is in regard to cameras, we would think the answer is along the lines of “they make and sell cameras to people who want their photos and video to look better than average”. That is the fundamental value they create, better than average photos and videos. By average we mean the quality offered by the premium smartphones of the day.

Who is willing to pay up for this value? Well, the answer appears to be content creators, and this group is growing at an incredible rate.

As content creators continue to proliferate and replace traditional forms of media, falling demand for interchangeable lens cameras should bottom out and start seeing healthy growth. This growth will be led by mirrorless cameras, the market Sony Corporation commands and which has been growing at a CAGR of ~3% in the face of the larger markets overall decline.

The number of YouTube channels is growing rapidly, with an overall growth rate of 23%. More importantly the rate of growth for larger channels is higher. These channels are typically professionally run and shoot their videos with professional grade gear.

Our research suggests that the vast majority of YouTube’s content creators’ brand of choice is Sony. Whilst also being subject matter experts in their channels given subject, content creators are also passionate photographers and videographers. All photographers and videographers love to talk about their kit and do so extensively on their channels where the majority list Sony Alpha cameras. In 2019 the number of these larger YouTube channels with over 100,000 subscribers grew by 40%.[3]

Market leadership within interchangeable lens cameras is hard to lose due to the large switching costs customers face. The large switching costs are caused by the fact that lenses are not compatible between manufacturers. This is combined with the fact that cameras are upgraded much more frequently than lenses.

Market share leaders have the largest assortment of lenses as well as the largest amount of third party support, making their cameras even more attractive to photographers and videographers. This is a strong flywheel effect that the market leader enjoys.

Canon and Nikon have an unbeatable position in available lenses for DSLR cameras, however, these lenses cannot be used properly with mirrorless cameras. This is due to the fact that the distance between the sensor and the lens is much closer within a mirrorless camera than in a DSLR. Sony’s lead is wide, with Sydney’s largest professional camera retailer listing 38 Nikon, 55 Canon and 120 Sony mirrorless lenses.

This is a fact that is being missed by the market that is distracted by the decline in DSLR sales and not focused on the growth in mirrorless camera sales, in which Sony Corporation leads. Mirrorless cameras are better suited for video recording due to their superior form of auto focus technology, which when implemented on DSLR’s increases their price significantly. DSLRs always require a second phase detection AF sensor because the primary image sensor is blocked whilst the mirror is engaged to allow use of the view finder.

The collaboration between Sony Semiconductor Manufacturing and Sony Corporation was focused in the areas of Electronic View Finders (EVFs) and on sensor based autofocus (AF). These were two areas where mirrorless cameras historically lagged well behind DSLRs, making them inferior substitutes.

Advancements and collaboration between Sony’s teams reached a tipping point in the second half of the 2010s, and as we can see below their hold on the mirrorless camera segment hasn’t budged, even in the face of an onslaught from competitors.

Mirrorless cameras utilise hybrid autofocus technology. This autofocus system is completely built into the cameras single image sensor, unlike DSLRs which also incorporate a second AF sensor. As light is always directed to the main mage sensor in a mirrorless camera the DSLR solution, which was typically faster, was not an option. Mirrorless cameras previously only used contrast AF, which was slower but more accurate.

Sony Semiconductor Manufacturing now lead in combing the two technologies onto a single image sensor, which Sony Corporation implements within their Alpha cameras to offer the interchangeable lens market's leading AF system. They do this by first using phase-detection focus (the traditional DSLR solution) to get close to a correct focus on the object. Then near the object Sony start to use contrast AF to get a clear peak focus which phase-detection focus cannot achieve.

In EVFs Sony Semiconductor Manufacturing are also the main supplier of EVFs to mirrorless camera manufacturers. With direct collaboration with the Alpha camera team the two Sony companies have designed and now manufactured EVFs that are near indistinguishable to the human eye compared to traditional view finders. The recent Sony Alpha 1, the company’s flagship camera, has a 9.44 million dot (over 3 million pixel), 240hz EVF that is the size of one’s thumbnail.

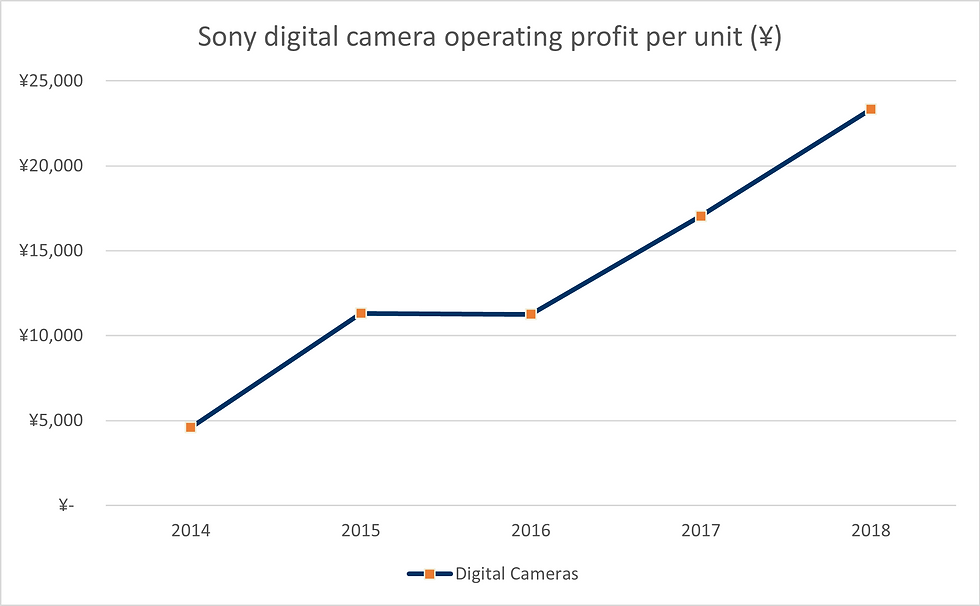

What we find ourselves left with is a market that no companies want to enter due to overall decline, high customer switching costs, mirrorless reducing costs for manufacturers and prices for consumers, and YouTubers with 100k+ subscribers growing at 40% per annum. Sony lead this market and whilst competition from incumbents such as Canon and Nikon will increase this will be mitigated by Sony already having a material lead in lenses. We can see how this market structure and Sony’s strengths have supported per unit operating profits in the below chart:

Videos and images will always be a relative medium. What we mean by this is that if you want your photos or videos to “pop” they will always have to be a higher quality than the average. The APS-C and full frame cameras from Sony and Canon are always going to look better than mobile. The same number of pixels on the same amount of space allows larger pixels and better lighting. This spells what we believe will always be a camera technology ahead of mobile and a constant demand from content creators, and that demand is growing incredibly fast.

We believe the market has missed this opportunity of growth offered by the digital camera business due to the fact that the market for digital cameras has been nothing but obliterated over the past decade by smartphones. This is evident in the below chart, which also shows that the interchangeable lens market was effected much less:

There have also been other distractions for investors at Sony Corporation. The market has been focused on the company’s smartphone business turnaround as well as monitoring for any signs that the TV business’s successful turnaround may prove temporary.

Considering this we think we should view Sony Corporation more and more as a growing, high-quality interchangeable lens camera company with high switching costs for customers and a durable lead in analog technology given Sony Corporation’s increasing collaboration with Sony Semiconductor Manufacturing.

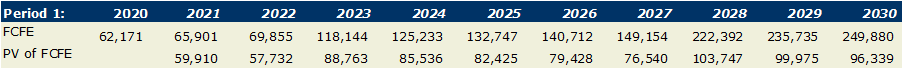

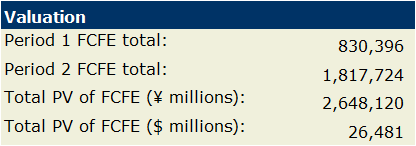

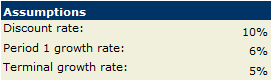

The results of this view produce a market valuation that differs considerably from the below DCF valuation. I have used a higher discount rate compared to the I&SS segment based upon our view that the E&PS business enjoys a less durable competitive advantage.

The growth rate used for period 1 is the 6% growth rate enjoyed over the turn around period. A long-term 5% growth rate has been used as it is inline with consensus forecasts for the long-run growth rate of the consumer electronics sector. These assumptions have produced the below DCF valuation:

Summing up

After we have looked at the I&SS and E&PS businesses it is clear that both benefit from durable competitive advantages and capable management. The durability of the competitive advantage is underpinned by Sony’s lead in advanced analog technology related to the conversion of light to information.

This quality is underpinned by the fact that expertise in analog technology is a highly specialised field, there is little crossover with other technologies unlike standardised digital protocols and design principles. This expertise is imbedded within experienced human-capital and company technical IP, neither of which are easily replicated.

It is evident management are capable and that they are holding a long-term view given Sony’s strategy of competing based on product features, in which they dominate, and not price. This has seen them already grab ~10% of the market for automotive CMOS sensors since they entered the market in 2016, an impressive feat.

Collaboration between Sony Semiconductor Manufacturing and Sony Corporation with the Alpha camera line shows us how management are breaking down walls between Sony Group’s companies, and the results are nothing but exceptional. This is only one example of collaboration, and there are many others, this was just the easiest to explain.

I&SS and E&PS are also collaborating in the company’s now profitable smartphone business, designing camera technology that is distinct from Apple and Samsung, and is proving popular with customers given a return to profitability. We should not forget that the company’s gaming business has also collaborated with the consumer electronics business to dominate the console gaming market over the past 2 decade. PlayStation 5’s are outselling the newest Xbox 2 to 1.

It is evidence of how strong the market narrative is that facts such as PlayStation’s success, a product of inter-Sony collaboration, doesn’t lead us to naturally believe that this is a company capable of collaborating. We will likely see success equivalent to the PlayStation’s in the interchangeable camera market with the Alpha camera series.

The sum of these two businesses standalone valuations is around JPY 6.6 trillion , or USD 66 billion USD. These businesses account for just under 30% of FY2020s operating profit, though the above valuation implies that they are worth 44% of Sony Group’s current market value. The remaining business, however, appear to have significant growth drivers of their own, are much less capital intensive and enjoy ever more scope for collaboration.

These businesses are Sony’s content and gaming businesses. The next instalment will be looking at how the two are sharing content IP to make leading exclusive games and movies based on games that are worth watching. These businesses appear even more exciting given how durable their competitive advantages appear, but just as importantly they appear to be trading even cheaper than I&SS and the E&PS segments.

[1] https://asia.nikkei.com/Business/Business-trends/Sony-and-others-race-for-control-of-self-drive-sensor-tech [2] https://www.ft.com/content/f3996f7c-2a5c-11ea-bc77-65e4aa615551

[3] https://www.tubics.com/blog/number-of-youtube-channels/

Comments